when you want, where you want.

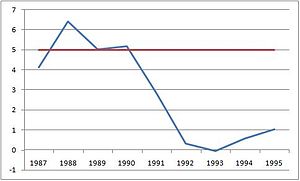

Gold Up, Housing Down

- Image via Wikipedia

Japan’s Nikkei jumped 5.7% after its worst two-day performance since 1987. However, investor sentiment in the region remains uncertain, given the ongoing crisis at the crippled Fukushima Daiichi nuclear plant. Other indexes also showed gains. The Shanghai Composite added 1.2%, South Korea’s Kospi gained 1.8%, and Hong Kong’s Hang Seng had a 0.1% rise. European stocks have had modest declines. Traders have taken cues from a downgrade of Portugal’s debt, with Moody’s slashing its rating by two degrees to “A3.” Spain’s IBEX 35 was off 1.2%, the French CAC 40 shed 0.8%, London’s FTSE 100 was down 0.7%, and the German DAX was fractionally higher.

U.S. Housing Units FallConstruction of new U.S. housing units fell in February, erasing a sharp gain in January and coming close to an all-time-low level. New homes were off 22.5% to a seasonally adjusted annual rate of 479,000, according to the Commerce Department—just 0.4% above the record low of 477,000 units set in April 2009 and the largest decline since March 1984.

January starts were revised higher to a 618,000 pace from the 596,000 previously reported. The 18.4% jump in January was due to an 87.4% surge in apartment starts, which analysts attributed to special factors. Economists were expecting some type of decline in February—but nothing close to the actual numbers. Analysts had forecasted starts to fall to around 570,000. But with house prices falling, home builders have little desire to boost construction, there is simply no need for housing starts given the excess supply of existing homes that are more attractive to buyers.

Starts of single-family homes fell 11.8% to a 375,000 rate, while starts of multifamily units dropped 46.1% to 104,000. In the past year, starts are down 20.8%. Starts of single-family homes are off 28.8%, while starts of apartments and condominium units have plunged 54.8%. The number of homes under construction fell 1.2% in February to a record-low 424,000 annual rate, while the number of units completed rose 13.9% to an annual rate of 581,000.

Starts fell across all four regions of the country, with single-family housing starts hitting a record low in the Midwest. The National Association of Home Builders reported on Tuesday that its measure of builder confidence edged up in March. However, a new constraint on starts are rising costs for building materials, Building permits fell 8.2% to a record-low seasonally adjusted annual rate of 517,000 in February. Building permits for single-family homes dropped 9.3% to a 382,000 rate. Many economists consider single-family permits to be the most important number in the government’s release.

Buying Opp For Gold?Is Gold no longer a “safe haven” investment? Gold futures have sold off sharply, despite continued uncertainty surrounding Japan’s devastating earthquake and tsunami. April Gold fell below the 1400.00 as a wave of liquidation in the commodity markets sparked a sell-off. Requests for liquidity may have forced some of the liquidation, but concerns that the global economy might fall back into a recession due to the Japanese crisis are taking some inflation “worries” out to the market.

Fundamentally, the outlook for Gold looks bullish. However, as many veteran traders know, the markets hate uncertainty, and until the situation in Japan starts to stabilize, flows out of Gold and commodities could continue as investors attempt to improve their liquidity. Longer-term, a major price decline could spell a potential buying opportunity. But traders looking for a short-term decline to buy Gold futures may wish to consider a Gold futures options spread. Diagonal spreads consist of long and short positions in an option of the same type but with different strike prices and different expiration months. An example would be June Gold trading at 1395.50. The May Gold 1370 puts could be bought and the June Gold 1345 puts sold for a credit of 1.10, or $110 per spread.

In a separate report, the Commerce Department said the U.S. current-account deficit narrowed to $113.3 billion in the fourth quarter, or 3.1% of gross domestic product, from $125.5 billion in the third quarter. The narrower deficit was accounted for by a decrease in the deficit on goods and services. The deficit is down sharply from the peak of 6.5% of GDP in the fourth quarter of 2005. But the deficit has been widening steadily after hitting a low of 2.4% of GDP in the second quarter of 2009. Also, the Labor Department said the producer price index rose 1.6% in February while core prices, excluding food and energy, rose 0.2%, triggering the biggest jump in food costs since 1974.

The U.S. Dollar Index is up about 0.3% at 76.55. Crude futures are also headed higher, after exploring four-week-low. The April crude futures contract has added 1.5% to $99.43 per barrel. Equity option activity on the Chicago Board Options Exchange (CBOE) saw 1,490,495 call contracts traded on Tuesday, compared to 1,073,923 put contracts. The resultant single-session put/call ratio jumped to 0.72, while the 21-day moving average edged higher to 0.61. The S&P Depository Receipts (SPY) show support in the neighborhood of $127.50 and resistance above $131.30. For the Nasdaq 100 (QQQQ), support is around $55.30 and resistance is near $58.35.

Related articles- The Case for and Against Gold (online.wsj.com)

- Economic Report: Falling U.S. housing starts close in on record low (marketwatch.com)

All Rights Reserved. Copyright , Central Coast Communications, Inc.